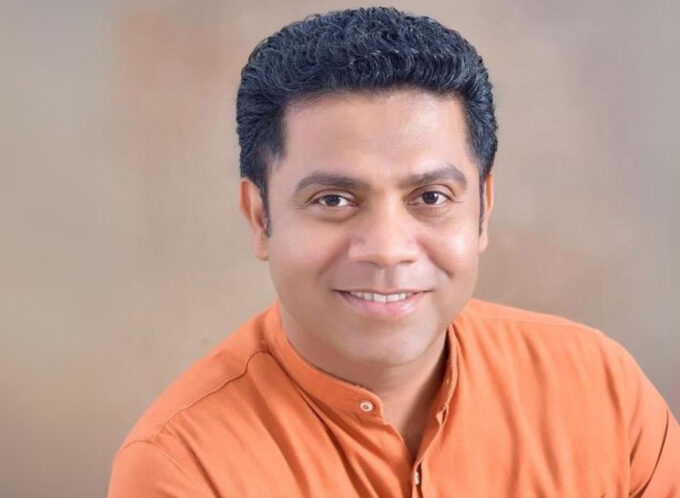

Dhammika Fernando, President of the Free Trade Zone Manufacturers Association (FTZMA), has stressed that providing investment incentives is crucial to generating a steady flow of foreign direct investment (FDI) into Sri Lanka, particularly as the government prepares to present the 2026 budget to Parliament on Friday (07).

Fernando highlighted that while there have been recent improvements, investment inflows remain slow, and achieving national benchmarks for foreign investment and net foreign exchange earnings requires targeted measures.

A key recommendation involves linking tax rates for BOI and non-BOI exports to a company’s Net Foreign Currency Contribution (NFCC).

Under the proposal, a 50% NFCC would attract a 12% tax rate, while a 30–49% NFCC would be set at 18%.

The FTZMA also advocates earnings-linked rebates, quarterly payments of 2–5% on incremental NFCC, and 150–200% super deductions for investments in R&D, certifications, and sustainability upgrades.

Fernando also emphasized the need for an Export Transformation Facility (ETF) to enhance value addition for exporters.

Proposed measures include ETF Concession Loans, risk-sharing arrangements with commercial banks, and Matching Grants of up to 50% for design, branding, certification, and intellectual property (IP).

The FTZMA also recommends Supplier Development Programs with 3–5% tax credits for exporters who integrate local SMEs into their supply chains.

To improve trade facilitation, Fernando called for speed, certainty, and low friction in government processes.

He proposed a ‘By-in-a-Week’ statute to guarantee Deemed Approval of investment applications within seven days, Green Channel Export Corridors for 24/7 clearance, and a 30-day WET (Wholesale and Export Tax) refund with interest for EU-certified exports.

He further urged the government to implement a risk-based e-refund system to replace SESFAT and ensure timely tax and duty refunds.

Addressing policy concerns, Fernando warned that policy inconsistency is discouraging FDI, as frequent changes in tax, customs, and exchange regulations create uncertainty.

The FTZMA urged the government to maintain stability, avoid retrospective taxation, and ensure continued duty- and tax-free access to capital goods and inputs.

Leave a comment