By Akshita Malik and Dr. Karamala Areesh Kumar

Sri Lanka’s economic downfall in 2022, marked by its first-ever sovereign debt default, cast a harsh spotlight on the perils of overreliance on external borrowing, weak fiscal discipline, and structural economic flaws. The convergence of the COVID-19 pandemic, supply chain shocks, and dwindling foreign reserves created a perfect storm, leading to widespread inflation, fuel shortages, and social unrest. Chinese-funded megaprojects, like the Hambantota Port, were at the center of scrutiny, often cited as evidence of Beijing’s growing economic stranglehold over Sri Lanka. As the country attempts to rebuild through foreign investments, the $3.7 billion Sinopec oil refinery deal has sparked renewed debate. Structured as a foreign direct investment (FDI) rather than a loan, the project has been hailed by some as a turning point in Sri Lanka’s investment strategy. However, the question remains: does this new partnership mark a break from unsustainable dependency, or is it merely a rebranded entry point for strategic control?

By 2022, Sri Lanka’s debt-to-GDP ratio had surged to 128%, with external debt totaling $51 billion, roughly 20% of which was owed to China. Foreign exchange reserves had dwindled to just $1.6 billion, barely enough to cover a month’s imports. This triggered an 80% devaluation of the Sri Lankan rupee and an inflationary spiral that peaked at nearly 70%. The crisis was exacerbated by declining revenue in key sectors. Tourism earnings plummeted from $4.3 billion in 2018 to a mere $800 million in 2021, while worker remittances—once a cornerstone of forex stability—fell by 40% during the pandemic. With a trade deficit exceeding $8 billion in 2021 and weak institutional capacity to manage debt, the country turned to the International Monetary Fund (IMF), securing a $2.9 billion bailout in March 2023.

The Debate of Debt Trap

Over the past two decades, China has emerged as Sri Lanka’s largest bilateral lender, financing major infrastructure projects such as the Hambantota Port, the Colombo Port City, and the Mattala Rajapaksa International Airport. While these initiatives were positioned initially as catalysts for economic transformation, many have failed to yield expected returns.

The Hambantota Port stands as the most prominent example. Financed through high-interest Chinese loans and unable to generate sufficient revenue, the port was leased to China Merchants Port Holdings in 2017 for 99 years. This triggered global concern about China’s Belt and Road Initiative (BRI) functioning as a strategic debt diplomacy tool, offering credit that results in long-term economic and territorial concessions. Similarly, the Mattala Airport—dubbed the “world’s emptiest airport”—became symbolic of resource misallocation and underutilized Chinese investments.

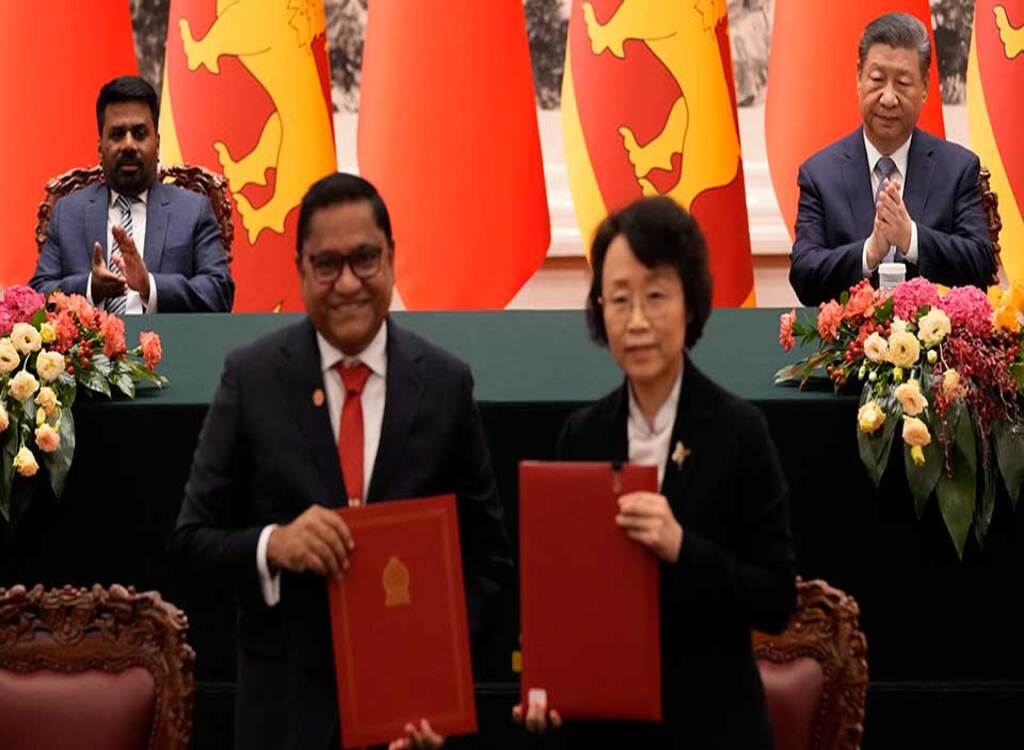

In contrast to previous projects, the Sinopec oil refinery is structured as a direct investment rather than a debt obligation. Estimated at $3.7 billion, it aims to produce 200,000 barrels per day and is expected to serve both domestic needs and export markets. Projections suggest it could generate annual earnings of $6 to $8 billion, potentially boosting foreign exchange reserves and reducing dependence on imported refined petroleum, which accounts for around 70% of Sri Lanka’s consumption.

The refinery is also expected to create over 2,000 direct jobs and stimulate secondary employment across related sectors. From an energy security standpoint, it could reduce price volatility in the domestic fuel market and anchor future industrial expansion. However, its success will hinge on several variables, including global energy market dynamics, operational efficiency, and regulatory oversight. Moreover, while its financing structure differs from traditional debt-based models, the strategic control exercised by a Chinese state-owned enterprise still raises geopolitical red flags.

China’s growing presence in Sri Lanka has not gone unnoticed by regional powers, particularly India, which views Beijing’s influence in its maritime backyard as a strategic threat. India has since increased its investments in Sri Lanka, particularly in energy and infrastructure, as part of a broader Indo-Pacific recalibration. The Sinopec deal also aligns with Beijing’s long-term BRI goals, reinforcing its economic foothold in the Indian Ocean region. Even without direct debt exposure, such deals can shift the balance of influence by embedding Chinese interests in critical sectors of the host nation. The concentration of Chinese control in ports, airports, and now petroleum infrastructure raises valid concerns over long-term strategic autonomy. The issue at hand has deepened due to the significant tax cuts under the regime of President Gotabaya Rajapaksa in 2019, drastically reduced government revenue, and widened budget deficits from about 5% in 2020 to 15% in 2022. These tax cuts included lowering VAT and corporate tax, abolishing PAYE tax, and other measures, severely impacting fiscal health. To cover this shortfall, Sri Lanka’s central bank started printing money, adding hundreds of billions of rupees into the financial system during 2022, despite IMF warnings that this would worsen inflation and economic instability.

Policy Recommendations

To navigate these complex dynamics, Sri Lanka must adopt a multi-pronged approach that protects national interests while leveraging foreign capital for development. Key strategies include

Investment: Actively courting FDI from countries like India, Japan, and Western democracies can reduce reliance on any partner.

Transparency: Independent audits and clear contractual terms should be non-negotiable to safeguard the public interest.

Strategic Safeguards: Critical infrastructure must remain under national jurisdiction or balanced joint ventures, especially when linked to energy or security.

Debt: Though the Sinopec deal is equity-based, broader financial governance reforms are essential to prevent repeating past missteps.

Cooperation: Collaborating with trusted partners on multilateral platforms could provide counterweights to unilateral dependencies.

The Sinopec oil refinery represents a potential economic windfall and a strategic crossroads for Sri Lanka. Unlike previous Chinese-funded projects, it avoids adding to the country’s debt load and promises tangible financial benefits. Yet the strategic control implicit in such large-scale investments cannot be ignored. For Sri Lanka, the challenge lies in transforming foreign partnerships into platforms for genuine development, rather than levers of external influence. Vigilance, diversification, and transparency must be the pillars of a forward-looking investment strategy. In a region where great-power competition is increasingly shaping economic choices, Sri Lanka’s ability to assert economic sovereignty while remaining open to investment will determine the success of the Sinopec project and the trajectory of its post-crisis recovery.

*Dr. Karamala Areesh Kumar is the Head of Dept. of International Relations, Peace, and Public Policy, St. Joseph’s University, Bengaluru, India.

*Akshita Malik is a Research Scholar, Dept. of International Relations, Peace, and Public Policy, St. Joseph’s University (SJU), Bengaluru, India.

*The article was published on Modern Diplomacy.

Leave a comment