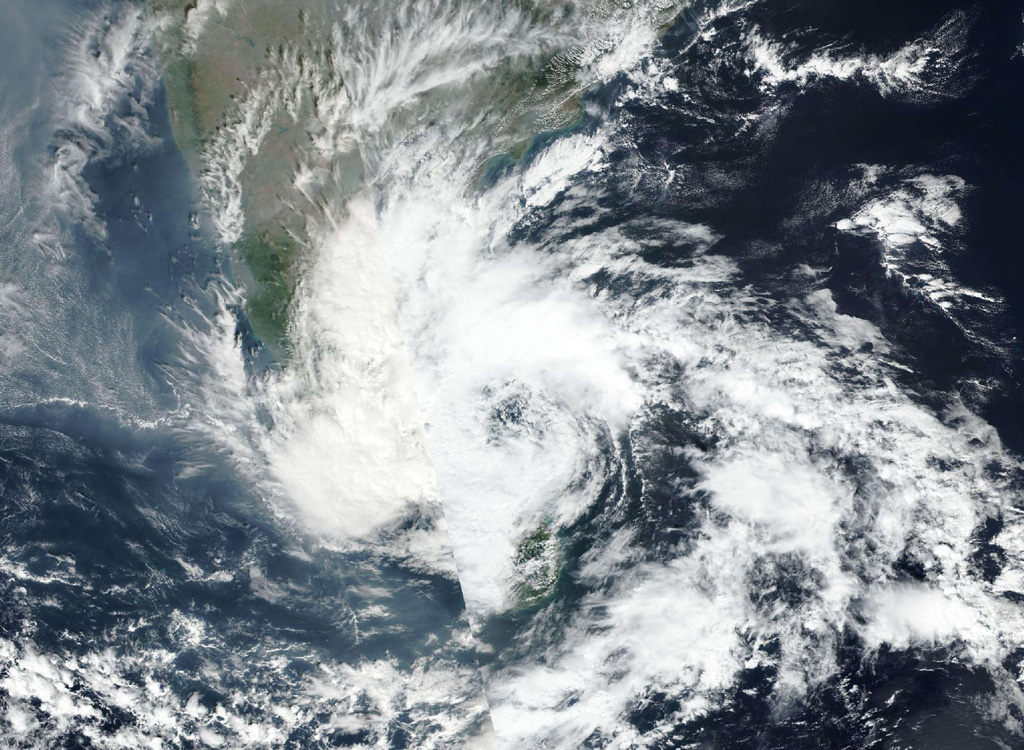

Sri Lanka’s efforts to stabilize its finances after last year’s debt default will face new setbacks as the government increases spending to address widespread destruction from Cyclone Ditwah, Moody’s Ratings said.

The rating agency said it does not expect the government to reverse reforms tied to its International Monetary Fund program, but warned that the storm’s economic toll will “stymie post-default fiscal consolidation.”

The cyclone severely damaged key infrastructure, including roads, bridges, rail lines and power grids, disrupting supply chains and economic activity across the country.

Moody’s said tourism, agriculture and manufacturing are likely to be the hardest-hit sectors.

Together they serve as major engines of growth and employment for Sri Lanka, which is still navigating its recovery from a historic financial crisis.

The agency also noted that several Southeast Asian nations have endured destructive storms this year.

Sri Lanka, along with Indonesia, the Philippines and Vietnam, faces high credit exposure to physical climate risks but Sri Lanka’s “much weaker fiscal capacity” limits its ability to build resilience compared with its regional peers, Moody’s said.

Governance will also play a critical role in mitigating climate-related risks, the agency added.

Both Sri Lanka and Vietnam hold governance issuer profile scores of 4, indicating high exposure to governance-related credit risks despite recent reform efforts.

Leave a comment