The Governor of the Central Bank of Sri Lanka (CBSL), Dr. Nandalal Weerasinghe, underscored the importance of strengthening credit information systems to improve access to finance, especially for micro, small, and medium enterprises (MSMEs) and other underserved sectors.

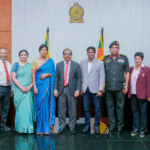

Speaking at the launch of the National Credit Guarantee Institution Limited (NCGIL) on Monday (02) in Colombo, Dr. Weerasinghe highlighted the challenges faced by banks in lending, pointing out that financial institutions are obliged to carefully manage risks when extending credit, given that they are lending public funds.

He stressed that the absence of comprehensive credit information on borrowers remains a key barrier to expanding credit in Sri Lanka.

“In more developed financial systems, credit information bureaus provide rich data that help lenders evaluate risk accurately, allowing them to extend credit even without collateral,” the Governor noted.

Dr. Weerasinghe called for enhancing the capabilities of the Credit Information Bureau of Sri Lanka (CRIB), emphasizing that reliable creditworthiness data is essential to empower banks and financial institutions to confidently and inclusively provide loans.

The newly established NCGIL aims to address this financing gap by enabling MSMEs to access credit facilities without collateral requirements.

The institution has been set up through a Public-Private Partnership (PPP) between the Government of Sri Lanka and 13 leading financial institutions.

The Asian Development Bank (ADB) has played a key role in supporting the initiative, providing an initial USD 50 million loan to facilitate the institution’s establishment and operational activities.

Leave a comment