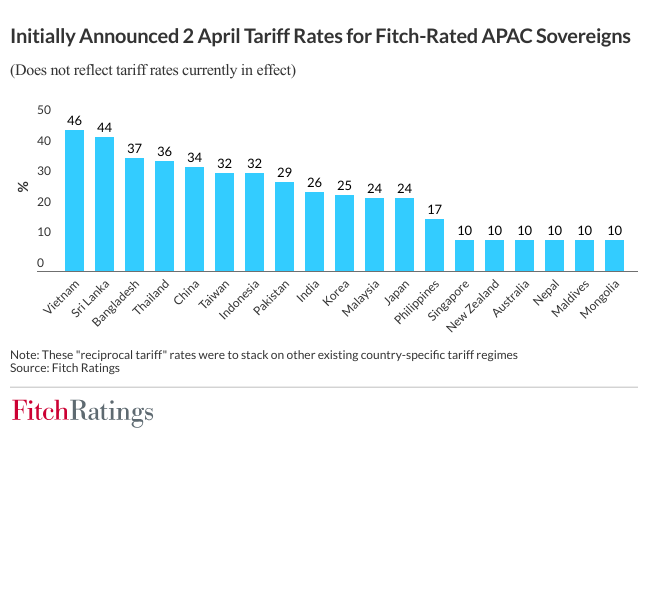

Increases in US tariffs will weigh on the credit metrics of many sovereigns in the Asia-Pacific (APAC) and risks will rise if higher country-specific tariffs are eventually implemented, says Fitch Ratings.

Sri Lanka is likely to be among the affected states when country-specific tariffs are eventually implemented.

The agency believes Asian economic growth will slow as exports and export-oriented investment are hit by tariffs and high uncertainty.

Fitch also pointed out that regional governments’ policy responses to the trade war will be key to its impact on APAC sovereign ratings.

According to the rating agency Foreign-exchange reserves could shrink if authorities intervene to support their currencies in the face of market pressure to depreciate following the tariff increases.

This could be credit negative for sovereigns with relatively low external buffers, such as Bangladesh, Sri Lanka and Vietnam, particularly if their export earnings are hurt by the tariffs.

“Tariff rates remain very volatile; for example, a temporary exemption for certain electronics goods was announced on 11 April that will, for now, mitigate the tariff impact for several APAC economies. Full implementation of the 2 April tariff rates (largely paused on 9 April) would amplify the negative effects of the trade war for APAC. Alternatively, tariff rates could fall, for example as part of bilateral deals. Some countries with relatively lower tariffs may benefit from trade and investment diversion over the longer term, but these effects are unlikely to be significant while trade policies remain in flux.

Regional governments’ policy responses to the trade war will be key to its impact on APAC sovereign ratings. Governments may opt to shore up economic growth with fiscal stimulus, for example. We believe some higher-rated jurisdictions have headroom to accommodate more fiscal support at their current rating level, including China, Singapore (AAA/Stable) and Taiwan. However, many APAC sovereigns have less headroom, given their high debt levels and limited fiscal consolidation since the pandemic. Sustained large-scale fiscal loosening could put downward pressure on some ratings, particularly if it led to a change in fiscal strategy over the medium term, as could be a risk in Thailand or Indonesia (BBB/Stable).

Slower global growth and weaker energy prices, lower domestic demand and generally moderate inflation could lead to swifter and deeper interest rate cuts than we anticipate in much of APAC, as well as slower rate increases in Japan (A/Stable). Such rate cuts could moderate interest burdens somewhat for sovereigns able to fund themselves via domestic markets. Measures to ease liquidity conditions may be employed as well. However, looser credit policy could aggravate leverage risks, which are a negative factor for some APAC sovereigns such as Vietnam.

Higher US tariffs could also cause the US dollar to appreciate against some APAC currencies, though the dollar has weakened in trade-weighted terms in April as investor sentiment towards US assets has soured. However, lower international oil prices and weaker domestic demand should reduce external financing needs for some jurisdictions and may contain the impact of higher US tariffs and slower global growth on exports.

Exchange rate depreciation could help to soften the impact of tariff increases on price competitiveness in the US market, but could also increase debt burdens for those with a large share of foreign-currency debt. Foreign-exchange reserves could shrink if authorities intervene to support their currencies in the face of market pressure to depreciate following the tariff increases. This could be credit negative for sovereigns with relatively low external buffers, such as Bangladesh (B+/Stable), Sri Lanka (CCC+) and Vietnam, particularly if their export earnings are hurt by the tariffs.”

Leave a comment